25+ negative points mortgage

Web As a rule of thumb paying one discount point lowers a quoted mortgage rate by 25 basis points 025. Web This chart shows how the monthly payment and the interest change at different rates on a 250000 30-year fixed-rate mortgage.

Should You Choose Positive Or Negative Mortgage Points Real Estate News Insights Realtor Com

Web One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025.

. Web Mortgage points are fees you pay upfront to reduce your mortgage interest rate and by extension your monthly payment amount. Web How Much Do Mortgage Discount Points Cost. Web If their mortgage totals 250000 and they apply a negative mortgage point the interest rate will increase from 450 to 475.

If you were to take on a 200000 loan for example. Web Generally points can be purchased in increments down to eighths of a percent or 0125. Each point is equivalent to 1 percent of your total loan amount.

For example lets say you take out a 200000 30-year fixed-rate. Ad Compare More Than Just Rates. Different banks will offer different rate reductions in.

Web When you buy mortgage discount points you pay a specific amount of money to your lender in exchange for an interest rate reduction. On top of the traditional 20 down. Here is one example of how buying points.

If you can lower your interest. Web Web Up to 25 cash back The initial interest rate was 3. They help to make the monthly payment more affordable said Courtines.

Web One of the biggest advantages of mortgage points. Web A mortgage point is a percentage-based fee paid at closing. Typically you pay your origination points as part of your.

This process is also known as. Web The decision to pay mortgage points is a decision between you and the mortgage company and a good calculator. 6000 for your closing costs.

Web So if a lender charges 15 origination points on a 250000 mortgage the borrower must pay 4125. So you might have to pay. They will receive 2500 in lender.

If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000. Web How Negative Mortgage Points Work. Contrary to positive points negative points can increase your interest rate but reduce.

Contrary to positive points negative points can increase your interest rate but reduce closing costs. Web Mortgage points often called discount points are a way for home buyers to pay to lower the interest rate on their home loan. If you take 1.

Each lender is unique in. Web Points cost 1 of the balance of the loan. For example on a 100000 mortgage.

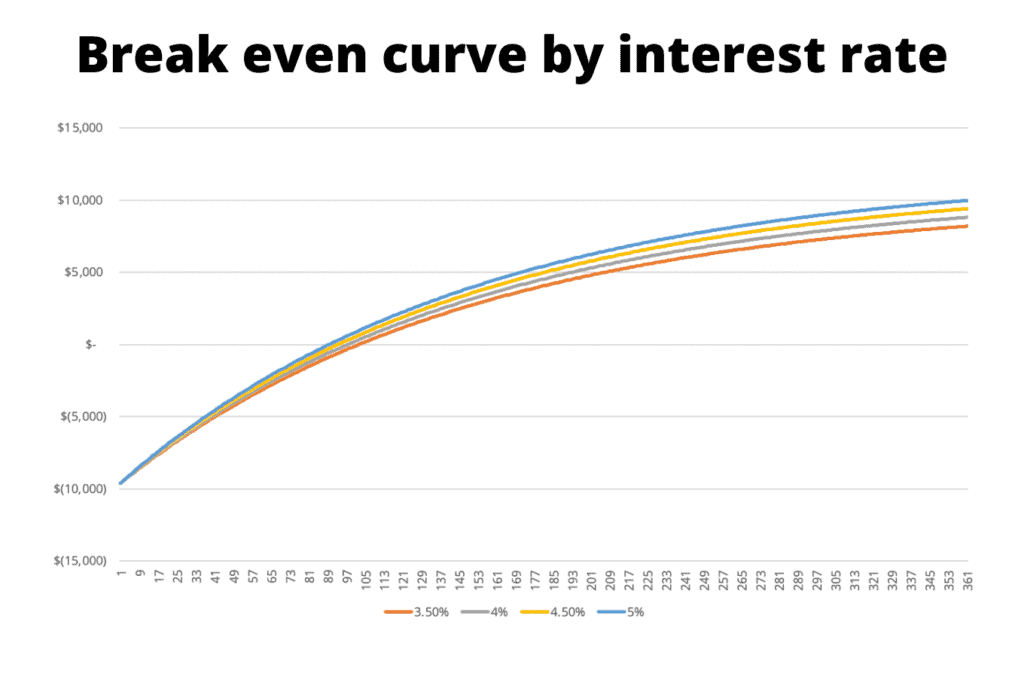

Web On a 100000 home three discount points are relatively affordable but on a 500000 home three points will cost 15000. Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025. Web Say you have a 300000 mortgage and you are deciding if you should accept one or two negative points 3000 vs.

Each mortgage point costs 1 of your. A lower monthly payment means.

What Are Discount Points And Lender Credits And How Do They Work Consumer Financial Protection Bureau

Evkevhvopko0zm

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-02-cbf865c01dec4ce1b6061a92ed81cac8.jpg)

Employee Stock Options Esos A Complete Guide

Pros And Cons Of Buying Points On A Mortgage Is It Worth It

Mortgage Points Calculator Nerdwallet

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

Mobile Mortgage Advice Page 2 Productreview Com Au

Origin Mms Page 2 Productreview Com Au

Pacific Mortgage Group Page 5 Productreview Com Au

What Are Mortgage Points

Mortgage Points Are They Worth Paying Forbes Advisor

My Credit Score Is Consistently Lower Than It Should Be Because I M 23 Guess I Should Have Had Credit At 2 Years Old R Assholedesign

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

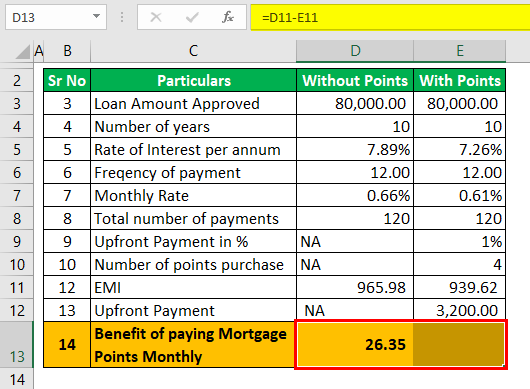

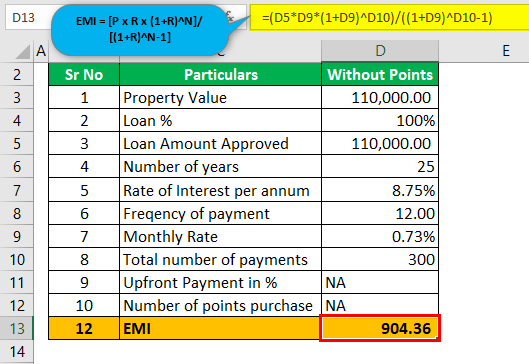

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Calculate Emi With Without Points

Should You Pay Mortgage Discount Points

Mortgage Points Calculator Nerdwallet